Mudra Research

Introduction

As an investor you are always on the lookout for the next big cryptocurrency to buy in 2021, that is likely to explode and make you rich. You read all these rags to riches stories, and you absolutely do not want to have crypto FOMO. However, hidden behind few hundred folks who have made fortune, are thousands or millions who have lost money in many crypto scams. As an investor you need to be able to spot and avoid these scam cryptocurrencies. This is even more important for new tokens, which are marketed heavily and being penny cryptocurrency have low barrier to investment. Eventually many of them will get rugpulled or dumped, and the token developers will run away with all the investor money.

Mudra Research is an innovative, first of its kind product, which assists you in finding if the BSC / BEP-20 cryptocurrency is legit and safe to invest.

Importance and Challenges of Research

The easiest way to make fortune out of cryptocurrency is to be an early investor in a promising cryptocurrency. To find such early yet promising projects, you need to do through analysis and research of token fundamentals. There is simply obscene number of tokens being released every day and it becomes exceedingly difficult to get all the information that you need to look at before buying. As a result, you end up relying on the partial information shared by the developers (devs) in their marketing posts or manipulated comments on reddit like forums. The result, you become the victim of pump and dump cryptocurrency. Not only you lose your investment on these scam coins, but it also degrades our trust in cryptocurrency and decentralized finance (DeFi).

Mudra Research provides you not only with an investment strategy for buying cryptocurrency but also makes it viable by automatically getting you all the information you need. This information is reliable, being sourced entirely from blockchain and contracts, nothing submitted by devs or crowdsourced.

How to do Research

Doing research for new BSC tokens is amazingly simple with Mudra Research tool.

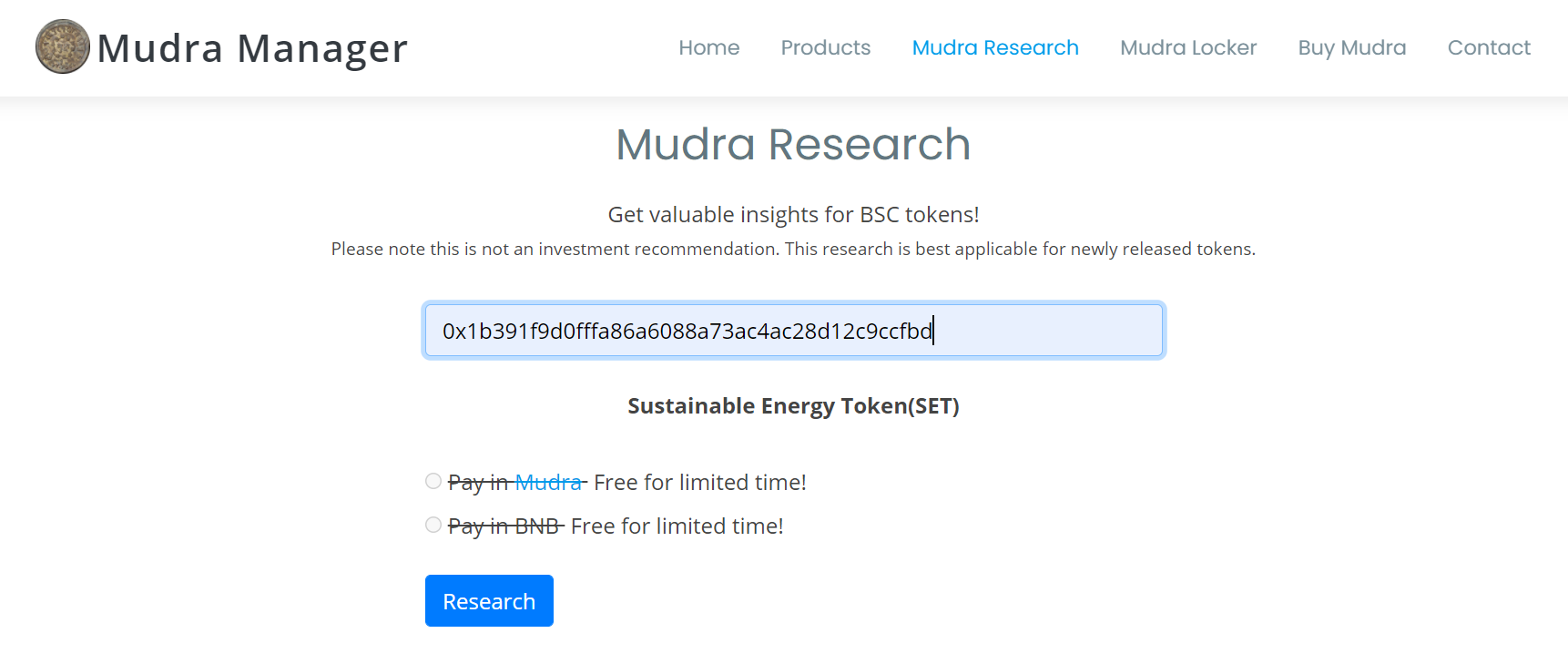

Step 1: Enter your BSC / BEP-20 token contract address in Mudra Research tool.

Step 2: Once the token has been found, click on Research button. In case you see some error, confirm the token address by searching in BscScan.

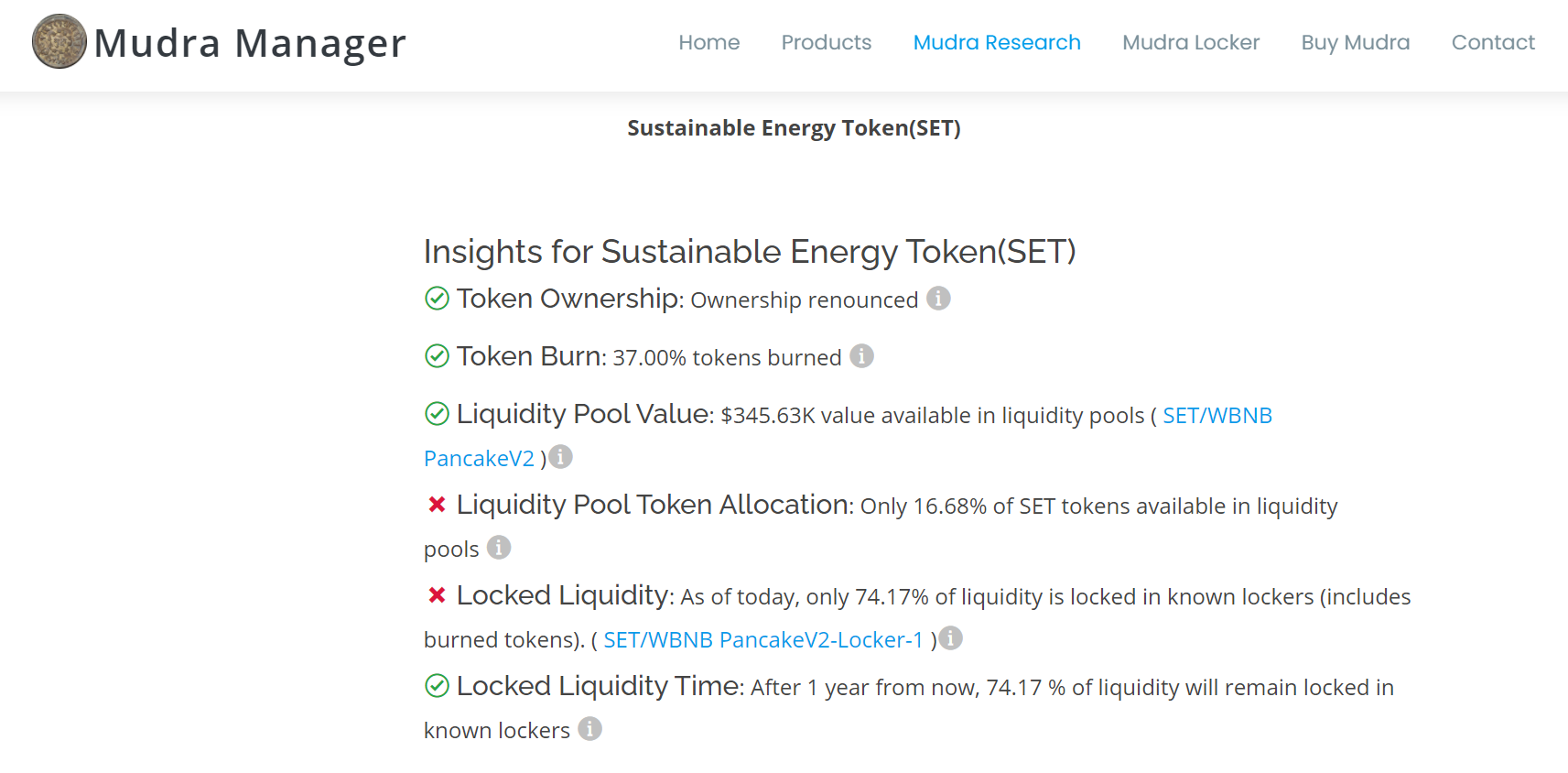

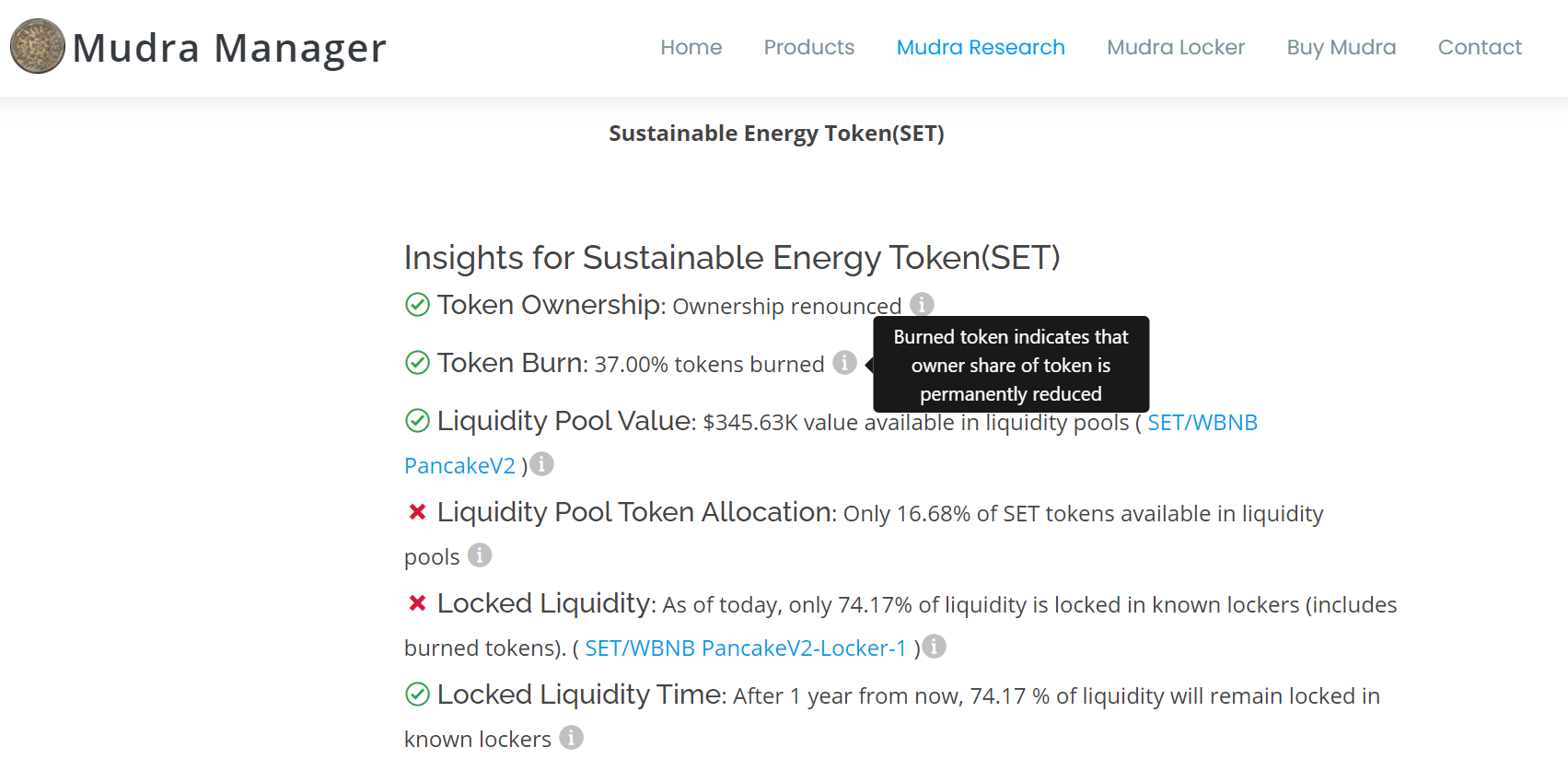

Step 3: Once the research is completed by the tool, you would see results like below.

Step 4: You can click on relevant links and hover on tooltip to get quick information on each metric.

Now let's look at each of these metrics one by one:

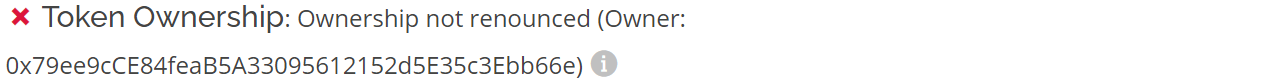

Token Ownership

This tells whether there is an owner with special privileges over the token or it has been renounced by assigning contract ownership to a burn address. Keep in mind while renouncing ownership is a good practice, token developers (devs) can still hardcode privileges into their token contract.

If ownership is renounced, you should see:

Otherwise:

Token Burn

This is the percentage reduction in available token supply by transfer to a burn address (typically 0x00..0 or 0x00..dead addresses which have no keys and cannot swap tokens). When devs burn tokens (30-50% is good), they reduce their share and minimize the likelihood of a dump.

If at least 30% of tokens have been burned, you would see something like:

Otherwise:

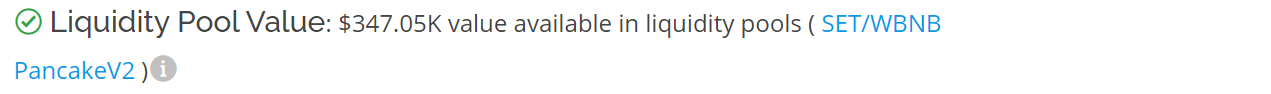

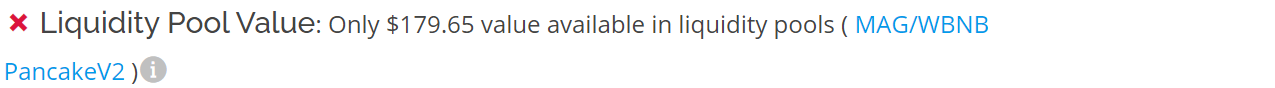

Liquidity Pool Value

The value of liquidity pools (LP) in USD. It is an important metric for a newly released coin. To facilitate trading over an exchange like PancakeSwap, devs have to create a liquidity pool (LP). Since LPs are created by pooling in BNB or other tokens of value, it represents an investment and commitment from the devs. A 100K worth of BNB tokens thrown in to create an LP pool is a good sign.

If a liquidity pool with at least $100K worth (considering only BNB/BUSD value) exists, you should see something like below. Please note the locked value and links to the LP token on BscScan are provided.

Otherwise:

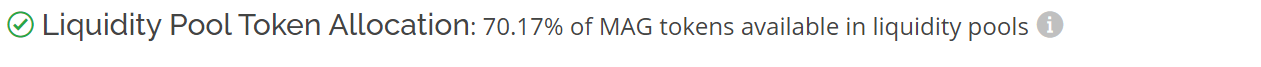

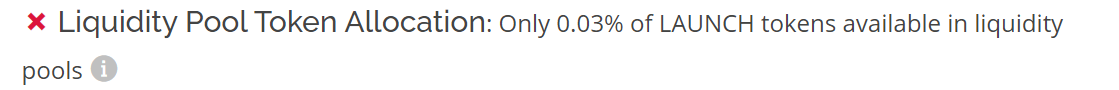

Liquidity Pool Token Allocation

The percentage of "tradable" token supply allocated to the liquidity pools. This is easily the most overlooked metric for a new token. After releasing a token, devs own the entire supply. They might burn some, airdrop or presale few. However, they would typically still own most of the "tradable" supply. To improve optics, they may distribute it over multiple wallets with no whale visible in holders list. If a high percentage of "tradable" token supply is allocated to LPs (which should be locked btw, more on that later), devs share is reduced and they cannot benefit from dumping their share. Otherwise, only with a small appreciation in the token price, they can benefit by dumping their share. For an intuitive idea, if devs own 90% "tradable" supply of a token and have created a high value LP with 10% supply, when devs dump all their share they will get back 90% (actually more than that) of their LP investments even if no one else ever traded their tokens. And when they manage to get few people to buy and increase the token prices, devs can make hefty profits even with locked LP. For newly released tokens, LP Token allocation percentage should be as high as possible, yes 100% is ideal but a 20ish % number is generally good indicator.

If token allocation to liquidity pool is more than 20% you would see:

Otherwise:

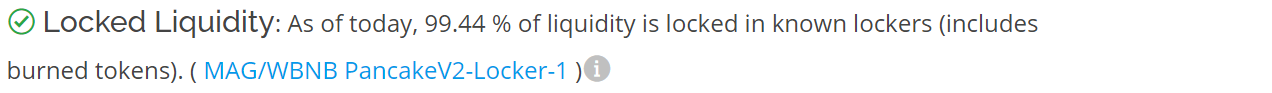

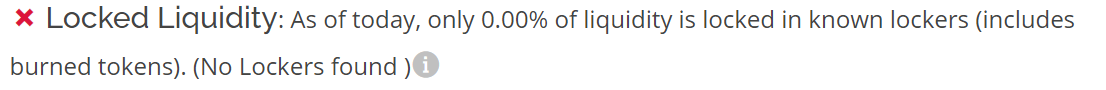

Locked Liquidity

This is the percentage of liquidity locked today so that devs cannot “rugpull” or withdraw the liquidity from PancakeSwap and run away with the money. Devs would renounce their right to withdraw liquidity by locking their LP tokens in a timed locker. Generally, well-known third-party lockers inspire the confidence rather than a custom locker contract.

Mudra Research automatically searches all the well-known BSC LP lockers, and you do not need to rely on devs word for it. If Mudra Research can locate a locker for token's liquidity, it will tell the liquidity percentage locked and will provide links to all the lockers:

If minimum of 80% liquidity is locked, you should see something like this:

Otherwise, it will show something like below:

Also check out Mudra Locker which is the most affordable and secure LP locker for BSC tokens.

Locked Liquidity Time

This metric indicates the percentage of liquidity locked, one year from now. This is arguably the most important insight. Devs might have locked liquidity for few months, which means they will just need to wait it out, before they can rugpull.

If more than 50% liquidity remains locked after one year, you should see something like this in Mudra Research report:

Otherwise, it will show: